Report of the findings of a preliminary e-invoicing interoperability framework (e-invoice exchange framework) assessment with an overview of the goals and approach used for the preliminary assessment along with key themes that emerged.market.Į-invoice Interoperability Framework Assessment Report (Off-site, PDF)

Provides business and technology stakeholders with an understanding of the high-level requirements and standards required to establish an open, federated network of access points for the U.S.market needs.Į-invoice Interoperability Framework – e-Delivery Network Feasibility Assessment Report (Off-site) In the past, your invoice process was probably paper-based. From SaaS services to healthcare, numerous businesses need to send out invoices and bills in order to get paid. Introduces the concept of an e-invoice interoperability framework (e-invoice exchange framework), as well as market challenges, the benefits of addressing them, and a path forward for the BPC’s work of assessing U.S. What is Electronic Invoicing and How Does it Work by Stax A key part that any business undertakes is sending out invoices.Overview of an e-invoice Interoperability Framework (Off-site) Read the report for more information on the approach, outcomes and recommendations. The BPC completed an initial proof of concept of a federated registry services model for the U.S.As a solution to these challenges, the exchange framework outlines a set of standards to securely exchange electronic documents, such as an e-invoice between businesses – even if each business uses different software.Į-invoice Exchange Framework – Approach to Managing a Federated Registry Services Model in a Four-Corner Network (Off-site)

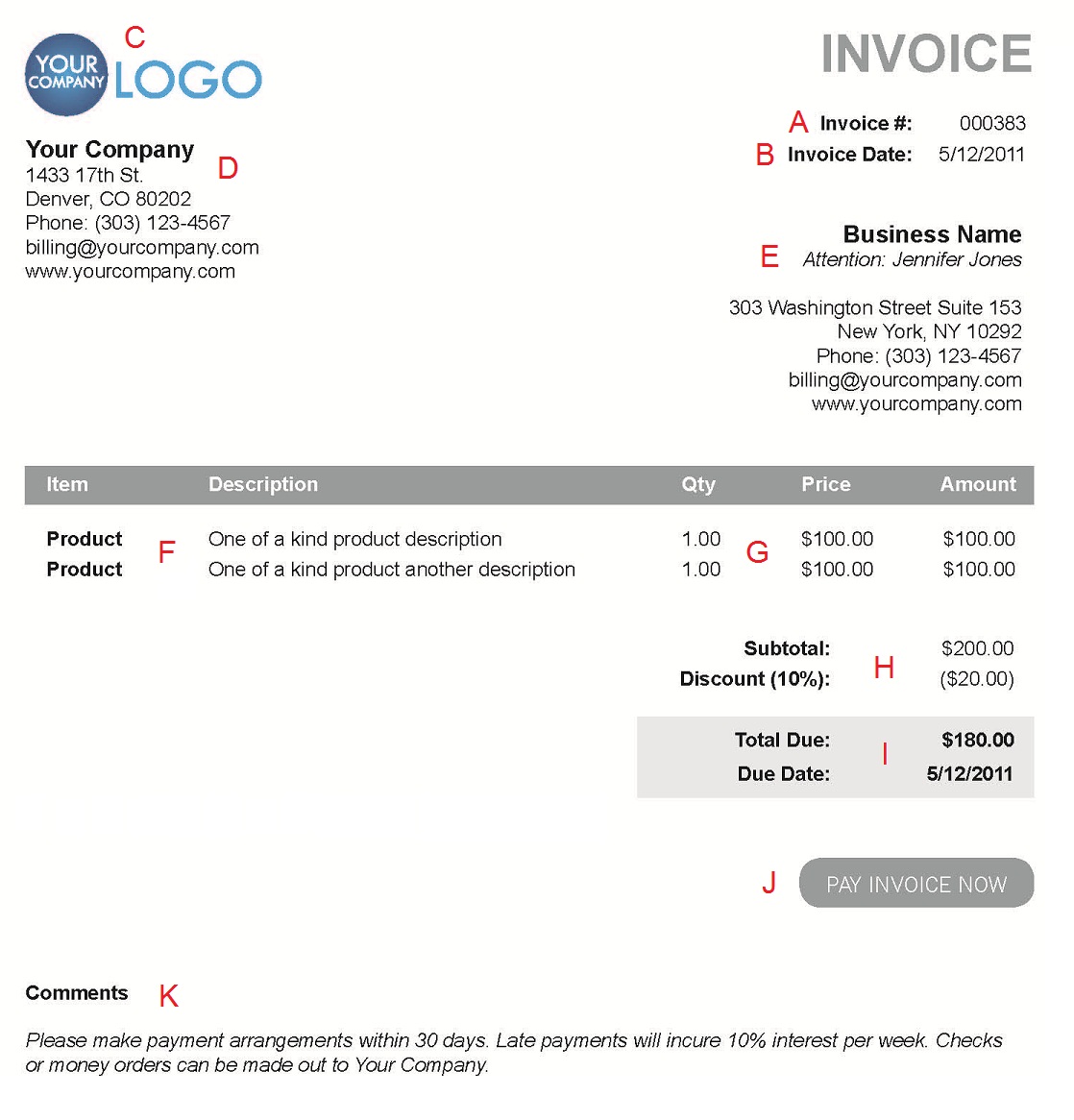

ELECTRONIC INVOICING HOW TO

It was developed to solve the difficult issues businesses face when exchanging invoices between different platforms and systems, such as how to connect to other businesses, what information to send and how to deliver it electronically. What is an Exchange Framework?Īn exchange framework is an electronic delivery network based on a set of technical standards and policies to allow businesses to securely share electronic supply chain documents with one another.

Through this partnership, industry work group efforts have supported the development, testing and implementation of an exchange framework, a virtual network that facilitates the exchange of e-invoices and e-remittance information. This includes processing any format (e.g., PDF, UBL. The Federal Reserve is working collaboratively with the Business Payments Coalition (BPC) to promote greater adoption of e-invoices, payments and electronic remittance (e-remittance) data to ultimately improve the efficiency of the U.S. Esker helps companies process e-invoices in compliance with the unique specifications of European countries.

ELECTRONIC INVOICING MANUAL

An e-invoice offers an opportunity to reduce manual effort for both buyers and suppliers-while supporting multinational compliance. Agencies don't have to develop or maintain individual systems.The electronic invoice (e-invoice) is a necessary first step to achieving straight-through processing for business-to-business (B2B) payments.Processing invoices is more efficient with less manual work, fewer steps, and no routing of paper or e-mails for approval.Vendors are responsible for entering invoices and increasing accuracy.The benefits of FIT's solutionĮ-invoicing is part of the solution FIT helped with and promoted for agencies to use FSSPs.Į-invoicing helps agencies in these ways:

ELECTRONIC INVOICING FREE

Invoice on the go Send invoices whenever and wherever you want with Wave’s free app for iOS and Android. The Department of the Treasury was looking for a more efficient and transparent way to handle invoicing for both federal agencies and commercial suppliers rather than for them to continue sending, receiving, and processing paper. Get paid faster Reliable, timely payments means better cash flow. One way of doing this is by using a Federal Shared Service Provider (FSSP) that offers e-invoicing. Vendors must have the option to submit their invoices electronically (Government Paperwork Elimination Act). The Office of Management and Budget (OMB) Memorandum 15-19, Improving Government Efficiency and Saving Taxpayer Dollars Through Electronic Invoicing directs agencies to manage invoices for federal procurements electronically. E2open eInvoicing helps you improve invoice accuracy and minimize audit risks using. Please enable JavaScript to use all features. Automate Electronic Invoicing Compliance for Over 50 Countries with. Some features of this site will not work with JavaScript disabled.

0 kommentar(er)

0 kommentar(er)